No internet?

No problem.

Insurerity offers microinsurance platforms for businesses looking to expand their insurance reach to low-income individuals and protect them from real perils in return for monthly premium payments.

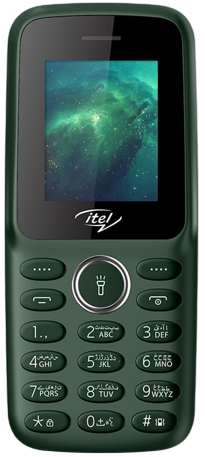

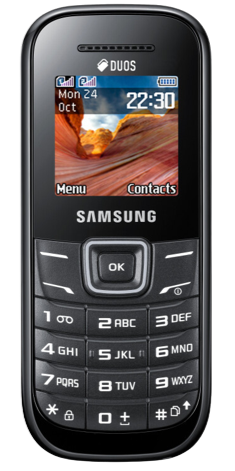

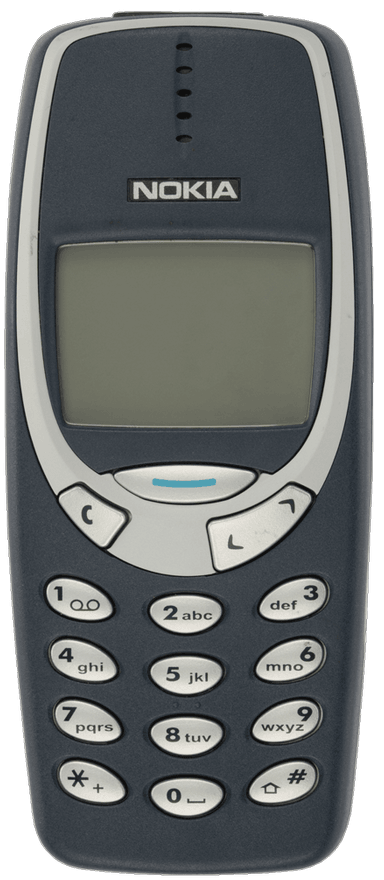

Accessible microinsurance, from any device.

Help your clients protect what matters most, with a solution designed to work on any mobile device, no internet required.

Welcome to Micro Insure!

1. Create an account

2. Purchase a policy

3. Make a claim

4. Check your policy

Insure the uninsured.

At Insurerity Digital, we believe that everyone should have access to insurance. That's why we are committed to providing innovative microinsurance solutions that make insurance accessible and affordable to those who are currently uninsured. Our microinsurance products are tailored to the unique needs of the African market, and our distribution channels can reach even the most remote areas. With our microinsurance solutions, we are working to bridge the gap in insurance coverage and bring financial security and peace of mind to people who need it most.

Simplify your microinsurance flows.

Simplicity is at the heart of our USSD solution. Our platform is designed to be easy to use, and work well with your customers. We provide a simple, intuitive menu that is easy to navigate, and a simple, easy to understand workflow that makes it easy for your customers to access microinsurance plans quickly and easily.

*1234*44#

Welcome to Micro Insure!

1. Create an account

2. Purchase a policy

3. Make a claim

4. Check your policy

2

Select a policy type

1. Credit-life insurance

2. Property insurance

Reconcile all your data in one place.

Easily access and manage all your client data in one unified dashboard with all the tools you need to make informed decisions. Our platform allows you to view and analyze all your data in one place, eliminating the need to switch between different systems. With this feature, you can easily track all your key metrics and make data-driven decisions to improve your business.

Collect premiums

automatically with direct debits.

Our direct debit feature allows you to setup automated and recurring premium payments linked to your clients mobile money accounts. This allows you to efficiently collect premiums from your clients without the need for manual intervention. Just sit back and watch your premiums roll in.

Pricing

To get started with our microinsurance solution, we charge a one-time setup fee of $1800. This fee covers everything needed to tailor the platform to perfectly suit your insurance requirements, ensuring a seamless and personalized experience. Additionally, a commission of 1.2% will be levied on all premiums processed through our system.

Premiums Collected

GHS

Commission Fees

GHS 1.20

Try Insurerity now

© Copyright 2026 Insurerity Digital Ltd. (“Insurerity”) and the Insurerity logo are registered trademarks.

All product illustrations on this website may not be indicative of the actual product and are for illustrative purposes only.

Insurerity Digital Ltd. is registered and certified by the Data Protection Commission of Ghana (DPC) under the Data Protection Act, 2012 (Act 843).

Use of Insurerity Digital Ltd. products and services are subject to the Terms of Service and Privacy Policy.

Insuredem is an affiliate of Insurerity Digital Ltd. that provides white label B2C insurance technology solutions to insurance brokers, agents, and insurers.

Insurerity Digital Ltd. is not licensed to provide actual insurance brokerage, agency, or insurance services, and is not a licensed insurance organisation. Insurerity Digital Ltd. only provides technology and services to insurance brokers, agents, and insurers.