Embracing the Future: Insurtech and IoT Revolutionizing Insurance

Engineering · Feb 13, 2024Explore how Insurtech and the Internet of Things (IoT) are reshaping the insurance landscape by revolutionizing risk assessment, personalizing policies, and streamlining claims processing while addressing challenges such as data privacy and ethical considerations.

Joselyn Nyadzi

Content Writer

In today's rapidly evolving digital landscape, the convergence of Insurtech and the Internet of Things (IoT) is reshaping the insurance industry as we know it. The integration of smart devices and IoT technology is not only enhancing operational efficiency but also revolutionizing how insurers assess risks, personalize policies, and improve the overall customer experience.

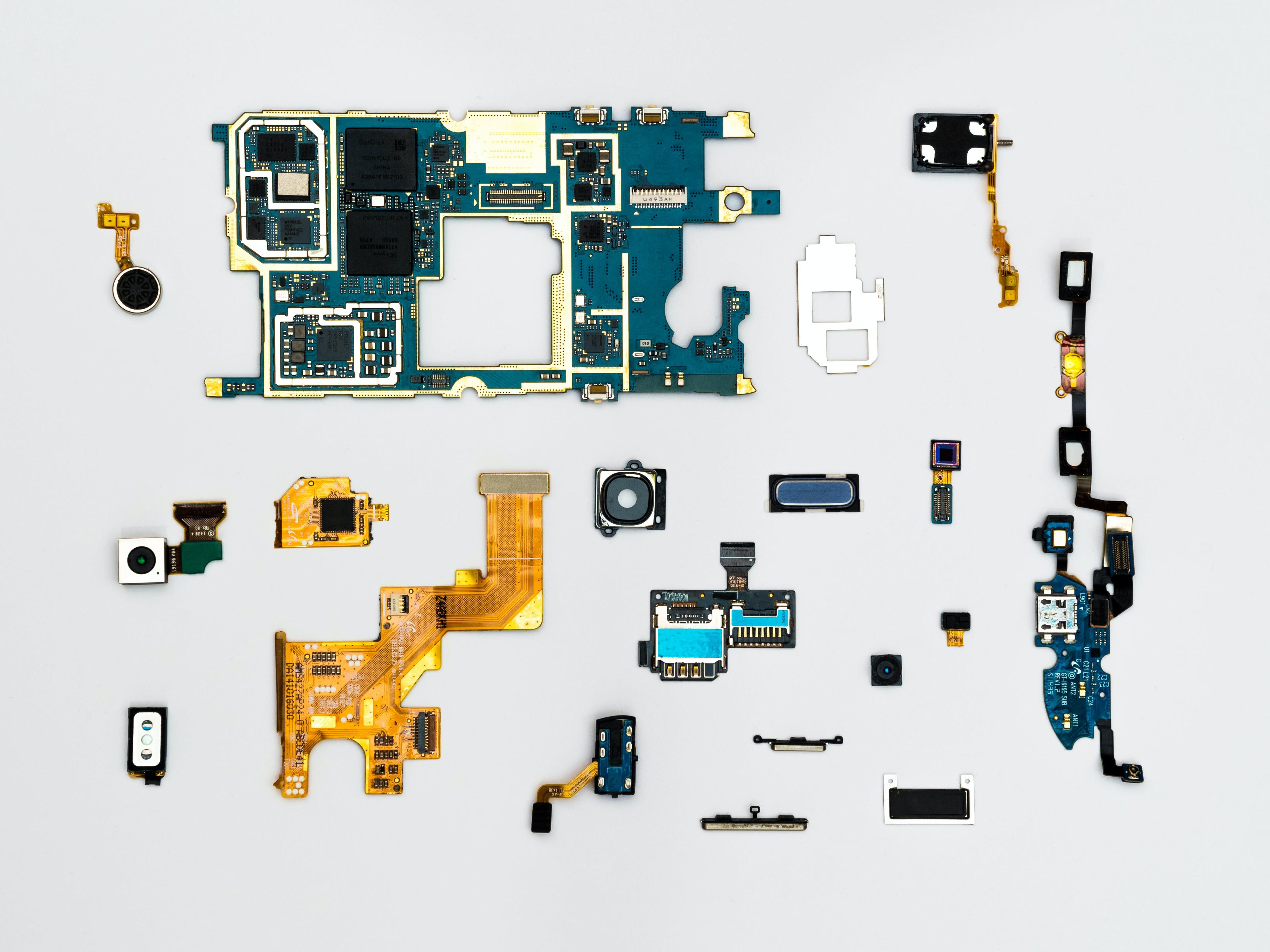

IoT devices, ranging from wearable gadgets to telematics systems in vehicles, are enabling insurers to access real-time data that was previously inaccessible. This wealth of data allows for more accurate risk assessment, leading to personalized and dynamic pricing models that reflect individual behavior and circumstances. For instance, telematics devices can track driving habits, enabling insurers to reward safer drivers with lower premiums while providing valuable insights for improving road safety.

Moreover, the interconnected nature of IoT devices is streamlining claims processing by enabling instant notifications of incidents. This real-time information not only expedites the claims settlement process but also helps to mitigate fraudulent claims, thereby reducing costs for insurers and enhancing customer satisfaction.

While the benefits of Insurtech and IoT in the insurance industry are undeniable, some challenges need to be addressed. Data privacy and security concerns, as well as ethical considerations surrounding the use of personal information, must be carefully navigated to build and maintain trust among consumers.

As we stand on the cusp of this connected future of insurance, insurers need to embrace innovation while upholding robust data protection measures and maintaining transparency in their operations. By striking a balance between technological advancement and ethical responsibilities, the insurance industry can harness the full potential of Insurtech and IoT to create a more efficient, customer-centric, and sustainable insurance ecosystem for the future.

© Copyright 2024 Insurerity Digital Ltd. (“Insurerity”) and the Insurerity logo are registered trademarks.

All product illustrations on this website may not be indicative of the actual product and are for illustrative purposes only.

Insurerity Digital Ltd. is registered and certified by the Data Protection Commission of Ghana (DPC) under the Data Protection Act, 2012 (Act 843).

Use of Insurerity Digital Ltd. products and services are subject to the Terms of Service and Privacy Policy.

Insuredem is an affiliate of Insurerity Digital Ltd. that provides white label B2C insurance technology solutions to insurance brokers, agents, and insurers.

Insurerity Digital Ltd. is not licensed to provide actual insurance brokerage, agency, or insurance services, and is not a licensed insurance organisation. Insurerity Digital Ltd. only provides technology and services to insurance brokers, agents, and insurers.